There are still many small to medium sized ecommerce merchants that struggle with the decision to embrace multiple fulfillment center locations to drive faster delivery transit times, potential transportation savings and an overall better experience for their customers. In most cases, these smaller merchants would be dependent on 3PL ecommerce order fulfilment service providers as the merchants lack the volume and scale to develop and manage their own dedicated fulfillment networks… it would just cost too much.

Numerous considerations and factors are impacting those small to medium sized merchants that have still not embraced multi-point ecommerce order fulfillment via a 3PL, to include:

- Faster Delivery Not Recognized as a Priority

- Undercapitalized to Fund Required Support Technology

- Lacking Tech Prowess

- Not Trusting of 3PL Order Fulfillment Management Solutions

- Failure to Embrace the Amazon Marketplace/Fulfillment by Amazon Option.

- Multi-Point Fulfillment Complicate Order Fulfillment Management

- Priority Mail is Still an Affordable 2-3 Day Delivery Solution… sort of

- Not Recognizing the Consumer’s Desire for Faster Delivery

- Availability of Low-Cost Deferred Ground Delivery Solutions

- Desire to Remain Small and Keep Things Simple

The question also begs, do the 3PL order fulfillment service providers even want the small merchant’s business? In many cases not, and this would be why:

- Small merchants tend to have a disproportionately higher number of issues/problems than larger merchants.

- Credit worthiness and slow pay can be a bigger problem with smaller merchants.

- The technology interface with the 3PL can be more difficult with the smaller client and require more hand-holding

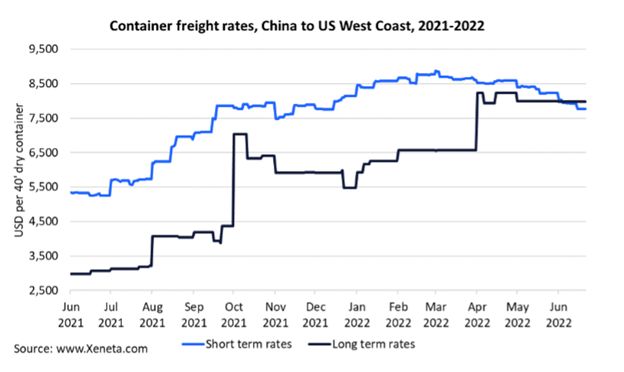

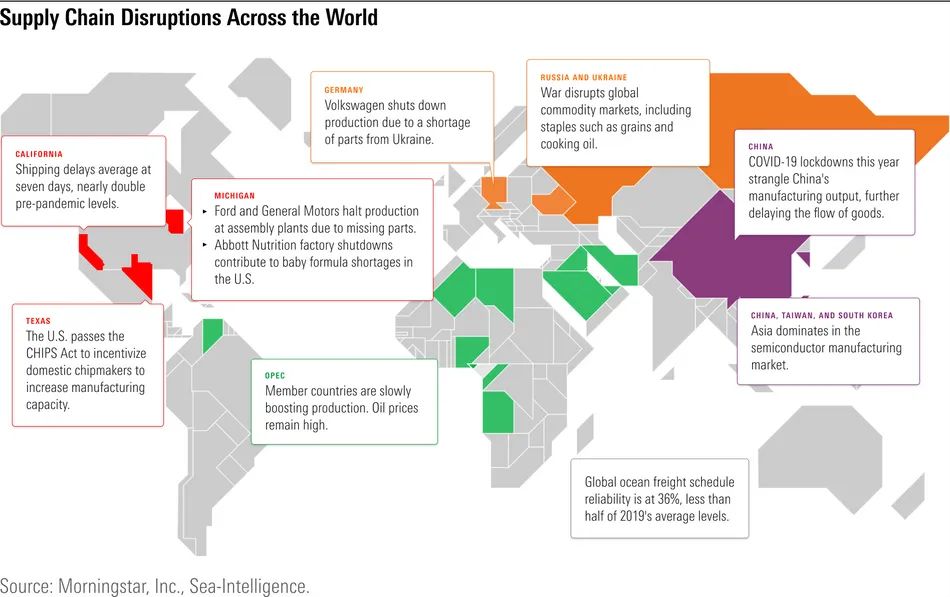

However, our slowing economy may very well drive more interest in the small merchant by the 3PL order fulfillment service providers as legacy large customer revenue declines in a slow economy and some large merchants fail. Additionally, smaller shippers are being disproportionately impacted by carrier rate increases and may very well experience lower transportation cost via a 3PL fulfillment relationship, whose carrier volume drives significant discounts. And finally, revenue streams from new, but smaller merchants will help 3PL’s meet carrier revenue requirements that drive their discounts.

It will be interesting to see how this plays out and whether declining economic conditions open the door for small merchants to embrace 3PL based, multi-point order fulfillment solutions that result in an overall improved service experience for their customers.