In recent years, parcel carrier pricing programs have grown more complex, with numerous surcharges applying to the base transportation cost. To some extent, the same phenomenon is taking place on the fulfillment side of the e-commerce distribution solution, which can make it difficult to calculate fully landed fulfillment costs. This can be a pain point for the merchant and exacerbates the complexity of identifying projected costs when trying to determine that cost across multiple quotes and service providers.

Fulfillment costs can include:

Receiving:

- Per Pallet Trailer: The charge will apply to a single pallet, 48x40x72, full or partial. There may also be a higher charge or extra-large pallets.

- Full Trailer, Pallets: This charge can be driven via the established per-pallet charge, or there may be a lower truckload charge.

- Partial or Full Trailer, Lose Loaded: An hourly rate per worker is normally assigned to the task.

- Small/Large Container Pallets: Trailer pallet rate should apply, although some service providers will look to container off-load as an opportunity for a premium charge. Also, container storage charges may apply per day until the container is picked up.

- Inventory Receipt: SP may charge to provide this electronic notification specific to the receiving function.

Storage:

- Pallet Charge Per Month: Applies to space standard pallet occupies, whether full or partially full. A higher charge will apply to oversized pallets.

- Volumetric Storage: Monthly fees assigned to square footage product occupies. Visual estimation can assign this rate or calculate it electronically via on-record product dimensions.

- Mixed Product Pallet: Surcharge may apply if the occupied cube cannot be calculated electronically.

- Lose Product Storage: Will normally be subject to a higher storage rate pallet charge.

- Large Item Surcharge: This May apply to large or oddly shaped products that cannot be housed on a standard pallet.

- Reserve Pallet Charge: Higher charge may apply to reserved pallet space, whether occupied or not.

Shipment Processing/Pick Charges:

- Order Charge: Per individual order, regardless of the number of individual items.

- Item Fee Parcel: Individual piece charges per order.

- Item Fee Pallet: Pallet pick charge.

- Shipment Processing-Label charge per piece.

- Additional Handling Charge: Extra charge for large, bulky, odd-shaped boxes or items not in a box.

- Packing Slip-Attached to outside of box/item, listing contents.

- Rush Order-Items requested to be immediately picked up upon receipt of order and made available for special pick-up.

PACKAGING:

- Service Charge: This applies to all packaged items.

- Materials: Outer Box charges which usually include inner packing materials.

- Inserts: (samples, brochures, gifts, etc.)

- Miscellaneous: Certifications, inspection, disposal (products or packaging), WMS license, TMS platform carrier rates.

Returns:

- Inbound Receiving: Receiving returned shipment.

- Item Processing/Restock: Return placed back into inventory to include inventory update.

- Flat Rate Returns Handling: Flat rate for all returns handling except reshipping (pick/shipping) charges.

Miscellaneous Charges:

- Stock Removal (Pallet): Normally, the pallet-based stock is picked for shipment to 3rd party for return to the shipper.

- Stock Removal (Parcel): Parcels being picked for reshipment. Same as pick/shipment processing charges.

- Stock Removal (Pallet): Pallets being picked for reshipment. Same as pick/shipment processing charges.

- Technology Set-Up: Per written contractual guidelines.

- Technology Platform Charges: (Monthly)

- New SKU: Updating inventory system for new items.

- Utilities Surcharge: (Monthly)

- Common Area Maintenance: (Monthly)

- Account Charge: (Monthly)

- Customer Service Inquiry Charge: (Per request)

- Special Labor Charge: (Per hour per worker)

- Inventory Reporting Charge: (Monthly)

- IT Integration Support/Problem Solving: (Hourly)

- FC Carrier Account Usage: Per item or Order.

Yes, there is a lot to digest here, but fortunately, not all these services/costs apply to every 3PL e-commerce order fulfillment solution. However, it is critically important that a merchant understand their cost per package/order for both fulfillment processing and transportation.

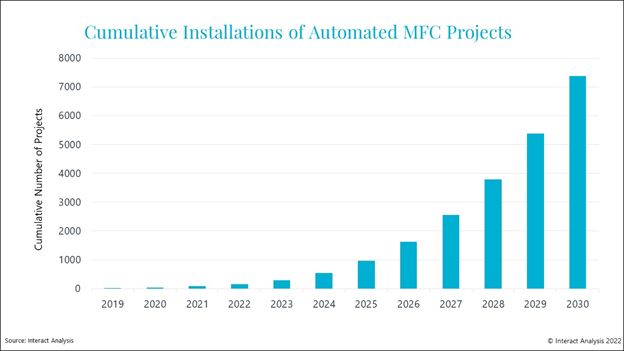

Of course, Amazon is leading the way in the development of MFC’s as they have opened 50 such facilities in NYC alone. All major urban markets are seeing the development of the smaller, micro fulfillment center, which cost a lot less to develop than the legacy model of large fulfillment centers.

Of course, Amazon is leading the way in the development of MFC’s as they have opened 50 such facilities in NYC alone. All major urban markets are seeing the development of the smaller, micro fulfillment center, which cost a lot less to develop than the legacy model of large fulfillment centers.