You would think that rising fuel costs and runaway inflation would be crushing profitability for 3PLs that support ecommerce-related order fulfillment. However, that may not necessarily be the case. So then, why are ecommerce order fulfillment service providers managing rising fuel costs and inflation better than expected?

- Fuel Surcharge is a variable, pass thru expense: For providers that resell transportation rates, they are already passing-on invoiced fuel surcharges to their fulfillment clients. This is a variable cost, and the merchants realize they are subject to this condition as it is usually stated in their terms and conditions.

Note that reputable order fulfillment service providers are not up-charging their clients on the fuel surcharge, as it is public knowledge and posted on the carrier’s web sites. Merchants would still be paying the fuel surcharge if they were having transportation billed through their own carrier account number.

- Scale absorbs inflation: High volume order fulfillment 3PLs can more easily absorb higher, inflation driven expense as increased expense is spread out across high volume item transactions.

- Robust sales pipeline: Another way to drive savings is to close new business. It is during these difficult economic times that the best order fulfillment 3PLs can lean on their sales team to close new business. This of course gets us back to scale and how improved scale can reduce overall operating expense, which goes directly to mitigating the overall impact of inflation.

- New technology reduces costs: Progressively managed 3PLs are constantly introducing new technologies that reduce operating cost and that can also help to off-set inflation related cost increases.

- Parcel Carrier Exclusivity: Both UPS and FedEx are structuring their pricing agreements to reward carrier exclusivity with deeper discounts. Superior transportation discounts can also help to offset higher, inflation-related expenses.

- Lower Cost Shipping Options: To better manage expense in this inflation driven business climate, order fulfillment 3PLs are also looking to use lower cost, deferred parcel transportation solutions.

A management team can’t directly control what they are paying for the cost of goods and services, being driven higher by increased fuel charges and inflation. That same management team can double down on reducing controllable expense, that will off-set inflation related higher costs, and help to protect profit margin.

However, even with the best cost reduction strategies and perfect managerial execution, increasing customer pricing is an unavoidable condition with 8% plus inflation. Customers should be sensitively notified, measures taken to reduce costs should be explained, and if possible, limiting the rate increase to under that of the inflation rate should be considered. Handling a rate increase in this fashion might also open the door to taking business away from competitors, which is a wonderful thing in a slowing economy.

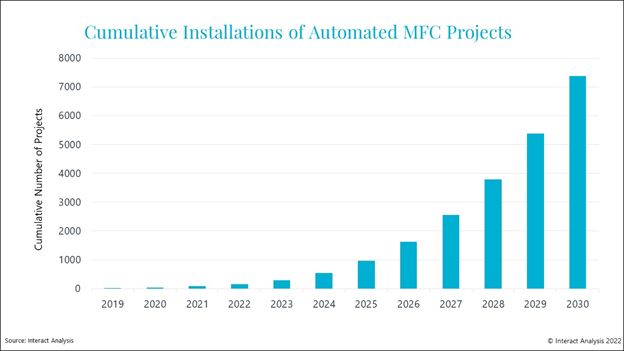

Of course, Amazon is leading the way in the development of MFC’s as they have opened 50 such facilities in NYC alone. All major urban markets are seeing the development of the smaller, micro fulfillment center, which cost a lot less to develop than the legacy model of large fulfillment centers.

Of course, Amazon is leading the way in the development of MFC’s as they have opened 50 such facilities in NYC alone. All major urban markets are seeing the development of the smaller, micro fulfillment center, which cost a lot less to develop than the legacy model of large fulfillment centers.